Clear and accuratefinancial reporting for law firms.

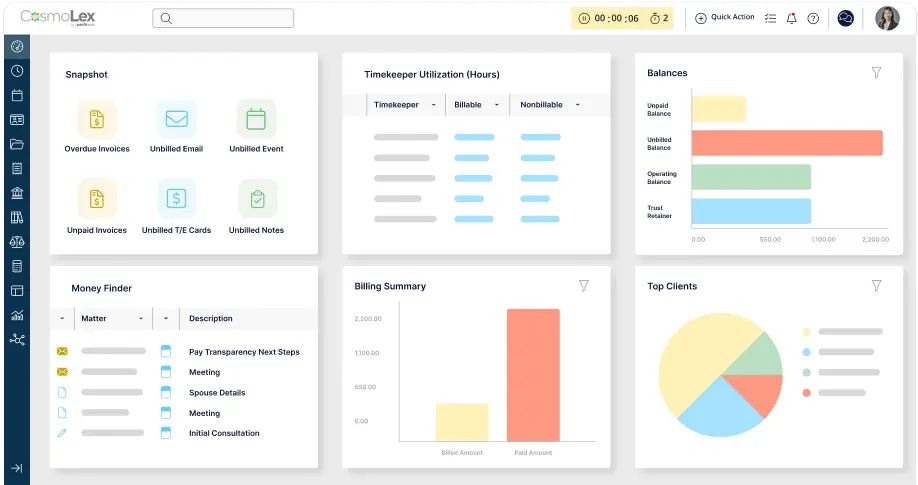

Law firms often face challenges with cash flow tracking, trust account compliance, and profitability analysis, making effective financial management a struggle. CosmoLex provides law firms with real-time financial insights and automated reports, eliminating the need for additional software or manual processes. Simplify your firm’s reporting needs and focus on growing your practice with confidence.

CosmoLex’s fully built-in law firm accounting and trust accounting software keeps financials in one place and up-to-date. CosmoLex has worked with firms for well over a decade in establishing the right financial reports firms want and need.

The most critical information on cash flow, balances, ledger reports, and more is easily and accurately at your fingertips

so you can make the right financial decisions for your firm.

Nearly a dozen trust specific reports gives a 360 degree view on the status of all your trust transactions and reconciliation.

Create and customize your reports for a full analysis of earnings and costs. Develop practice area-specific reports to understand which parts of your practice are most profitable. Report on all the details of time and expenses and collection rates to solve problems for your firm.

All the tools your firm needs

to run your business.

Built with the needs of modern small and mid-sized law firms in mind, CosmoLex’s legal practice management software increases efficiency and profitability.

LEGAL PRACTICE MANAGEMENT RESOURCES

Access CosmoLex‘s free materials on how to elevate your legal practice management.

- Integrated Accounting Software for Law Firms: Features, Benefits & More

- 5 Reasons Law Firms are Switching to CosmoLex

- Optimizing Law Firm Operations: 5 Strategies for Modern Practices

- The ROI of Switching to CosmoLexPay: Cost Savings and Efficiency Gains

- 6 Best Practices for Creating a High-Converting Law Firm Website

Law firm accounting refers to the specialized accounting processes used to manage the financial activities of a law firm. It involves tracking and organizing the firm’s finances, ensuring compliance with legal and regulatory requirements, and providing accurate financial reporting to partners, managers, and stakeholders.

CosmoLex ensures trust accounting compliance by integrating trust account management directly into its platform, helping law firms handle client funds with accuracy and transparency. Automated safeguards prevent common errors like overdrawn accounts, while detailed compliance reports make audits stress-free.

Small law firms benefit from financial reports like cash flow statements, profit and loss statements, and trust account reconciliation reports. CosmoLex provides these reports in real-time, helping firms monitor financial health, maintain compliance, and make data-driven decisions.

Yes, CosmoLex is a complete replacement for QuickBooks, offering legal-specific features like trust accounting, matter-based billing, and financial reporting in a single platform. With no need for third-party software, it simplifies workflows for law firms.

CosmoLex stands out by combining legal practice management and accounting in one platform, eliminating the need for integrations or external tools. Its legal-specific features, like trust accounting compliance and matter-based reporting, cater directly to the needs of law firms.

CosmoLex helps law firms improve cash flow by streamlining invoicing, automating payment reminders, and providing real-time financial insights. These tools ensure faster payments and better financial planning for consistent cash flow.

Yes, CosmoLex is fully compliant with legal accounting regulations, including trust accounting rules and IOLTA requirements. Built-in safeguards and automated compliance tools help law firms avoid costly errors and penalties.

Switching to CosmoLex is seamless with its guided data migration process and expert support. The platform ensures your firm’s data is transferred accurately and efficiently, minimizing downtime.

Simplify your practice with one tool.