Comprehensive, compliant, and automatic Trust Accounting System.

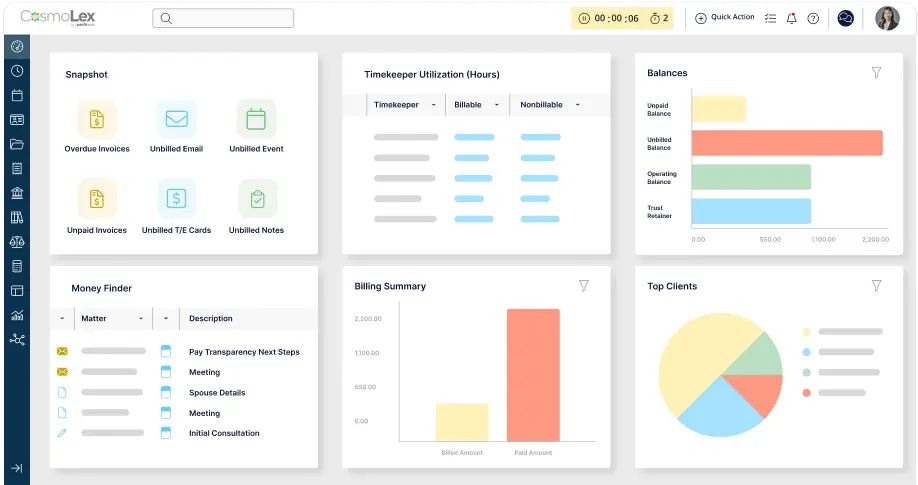

CosmoLex’s accounting software will do all your law firm’s trust bookkeeping – automatically, in the background, in real-time.

- Natively built in CosmoLex.

- Single ledger or multiple trust accounts separated from operating accounts.

- Automatic transfer of funds from trust account to general.

Keeping your clients’ trust accounts reconciled monthly is mandatory and typically the first thing an auditor will review.

- Simple reconciliation with CosmoLex general accounting.

- Prevent common trust accounting mistakes like ledger overdrafts or comingling.

Having native-built legal accounting and trust accounting tied to your practice management tools means the elimination of many manual tasks.

- Automatic transfer of funds from trust account to operating account.

- Import electronic bank statements and auto-reconcile.

- One-click three-way reconciliation reporting.

- Online payments automatically applied to trust funds.

- Bank-grade encryption standards and two-factor authentication to protect all data.

All the tools your firm needs

to run your business.

Built with the needs of modern small and mid-sized law firms in mind, CosmoLex’s legal practice management software increases efficiency and profitability.

LEGAL PRACTICE MANAGEMENT RESOURCES

Access CosmoLex‘s free materials on how to elevate your legal practice management.

- Integrated Accounting Software for Law Firms: Features, Benefits & More

- 5 Reasons Law Firms are Switching to CosmoLex

- Optimizing Law Firm Operations: 5 Strategies for Modern Practices

- The ROI of Switching to CosmoLexPay: Cost Savings and Efficiency Gains

- 6 Best Practices for Creating a High-Converting Law Firm Website

Trust accounting is a form of law firm accounting that manages client funds held in trust accounts. In the legal industry, trust accounting is governed by specific compliance rules based on jurisdiction and state bar requirements that attorneys must abide by. For example, client funds in trust accounts cannot commingle with money held in the law firm’s general accounts. Additionally, any fees for storing trust account funds, like credit card processing fees, must be charged to the law firm, not the client funds.

Finally, law firms of all sizes are required to provide detailed records of trust accounts, including bank reconciliations.

Because the rules governing client funds and trust accounts are specific and complex, many legal professionals find it easier to use trust accounting software to help ethically manage these complex accounts.

However, generic small business accounting software, like QuickBooks Online, isn’t equipped to manage these accounts while ensuring compliance with legal standards. As such, the use of these products can actually create more work for attorneys and other legal professionals since complex workarounds must be used to manage trust transactions.

Legal practice management software solutions that include trust accounting software allow law firms to handle firm financials and legal trust accounts with ease. CosmoLex’s legal trust accounting software was designed for trust accounts, with built-in features that ensure compliance with complex legal standards. Because CosmoLex’s legal accounting software integrates with its other functions, like practice management and billing, CosmoLex streamlines financial processes for firms, meeting law firms’ accounting needs while reducing syncing errors between programs or time spent performing duplicate data entry.

Here are the most common scenarios in which an attorney is responsible for a trust account:

- For funds received at the start of representation

- In connection with a payment from a settlement

- When the attorney is acting as a fiduciary agent on behalf of a client or their estate

Only certain types of funds can be placed into a trust account:

- Settlement funds, such as those obtained through a personal injury case

- Unearned income paid to the lawyer or their firm before services have been rendered (e.g., fees, cost advances, and retainers)

- Advances for costs that a law firm expects to incur associated with managing the case

- Judgment funds awarded by the court (like some settlement funds)

- Third-party funds, including those obtained from the sale of client property or chosen for payment to a third party for their services

Trust accounting is important for firms due to multiple reasons:

- Adherence to Ethical and Legal Standards – Trust accounting guarantees that legal firms meet the legal standards concerning the handling of client funds. Lawyers are obligated to handle client funds with care, ensuring they are kept separate from the firm’s funds.

- Prevention of Misuse – Proper trust accounting practices aid in preventing the misuse of client funds. By keeping records of all fund transactions on behalf of clients, legal firms can show transparency and accountability.

- Establishing Client Confidence – Clients rely on law firms to manage their finances responsibly. Following trust accounting protocols helps instill and uphold trust between the firm and its clients, assuring them that their funds are safeguarded.

- Avoidance of Legal Ramifications – Mishandling client funds can result in repercussions, such as disciplinary actions, penalties or even disbarment for attorneys. Adhering to trust accounting compliance aids firms in steering of these potential consequences.

- Preservation of Professional Standing – Trust account management reflects a law firm’s professionalism and integrity. Failing to handle client funds correctly can tarnish the firm’s reputation and credibility, potentially leading to a loss of clients and business opportunities.

- Ensuring Audits and Evaluations – Legal firms might undergo audits or evaluations by agencies or bar associations to verify adherence to trust accounting guidelines and regulations. Keeping trust accounting documents simplifies these procedures and highlights the firm’s commitment to compliance.

Lawyers managing client trust funds have the following key responsibilities:

- Safeguarding the funds in the trust accounts

- Keeping the trust funds separate from those of the firm

- Maintaining accurate records of the account (trust accounting)

To ensure compliance with trust accounting legal and ethical standards, lawyers should adhere to their state’s rules regarding trust accounting, reconcile the account monthly, keep diligent records of the account, including all trust requests, and communicate clearly and transparently with their clients about their trust accounts.

CosmoLex’s comprehensive solution for law firms is packed with all the features of trust accounting that legal teams need to manage complex transactions for trust accounts. And the best part is these trust bookkeeping tools work automatically in the background while users work on other tasks within the legal billing software.

To start with, CosmoLex has built-in protection tools for trust accounting, like a stoppage on ledger overdrafts and fund commingling. With this tool, trust accounting software finds errors and reports them faster. In fact, law firms can easily perform effortless trust reconciliations with our audit-ready tools that ease mandatory trust accounting requirements. Running bank reconciliations, including three-way reconciliations, can be done in just a few clicks, and financial data reports can be archived for security purposes.

Finally, CosmoLex automatically provides thorough, complete trust financial reports, including account balance reports, ledger activity summary reports, and ledger transaction reports. Having these trust reports on hand ensures attorneys are always prepared in case of an audit.

CosmoLex is the best trust accounting software for a reason—we take the guesswork out of navigating these complex accounts and give legal professionals peace of mind to feel confident in handling trust financial data.

We get it, sometimes you want to try before you commit to a new legal practice management software, especially when your firm’s trust account compliance with regulations is on the line. That is why we offer a free 10-day trial of CosmoLex for interested law firms (no credit card required) and schedule free demos for interested customers. The free trial offers all the same functionality as a paid subscription, so legal firms can get a real taste of all the tools CosmoLex uses to maximize profitability and boost productivity before they select to move forward.

We want to ensure your legal practice is satisfied with our suite of comprehensive cloud-based software services. With all-inclusive pricing and no long-term contracts, CosmoLex is the safe legal practice productivity solution you have been looking for. To see how your firm can use our legal trust accounting software to streamline financial processes, fill out the interest form on our website and get started using CosmoLex today.

At CosmoLex, we put immense value on data security with all our cloud-based software, which is why we abide by enhanced security standards that are independently reviewed by outside cybersecurity auditors. We store all data in North America; depending on the location of your firm, your data may be held in a data center in either the U.S. or Canada.

In addition to keeping all data stored close to home, we use other cybersecurity best practices, like requiring two-factor authentication on all accounts. We store all data in an encrypted state, so confidential information can never be accessed, even in the case of a breach. Additionally, all data in our software is encrypted by military-grade 256-bit SSL encryption, bank-level security, and all data on our servers is backed up every few hours, so data is protected even in the case of a power outage or other natural disaster.

To demonstrate our high security standards, we have completed the SOC 2 Type 2 security attestation. To achieve this certification, we submit a formal audit by a cybersecurity investigator.

CosmoLex helps firms stay in compliance with regulatory requirements in the legal industry. For example, our trust accounting software supports incredibly strong security standards, ensuring client documentation is always safe and secure. Because lawyers have an ethical duty to ensure client confidentiality, CosmoLex helps small and mid-sized law firms stay in compliance by encrypting information and securely housing documents and data.

One major concern for many law firms accepting online payments is staying in compliance with the rules surrounding trust and IOLTA accounts. These rules dictate that trust money cannot be commingled with operating funds in general accounts, that credit card processing fees from online payments cannot be taken from client accounts, and that comprehensive three-way reconciliations be performed daily for trust accounts.

CosmoLex has specific safeguards in place to prevent breaches of legal compliance when working with these complex transactions. For example, CosmoLex’s credit card processor, CosmoLexPay, automatically pulls fees from a designated legal account instead of from the client account. This feature saves you time and money.

As the best trust accounting software, CosmoLex also helps law firms meet ethical and legal requirements by providing marketing automation tools, billable time tracking and document organization, task management, document automation, and more, ensuring all attorneys provide prompt representation to every client throughout the entire process.

CosmoLex’s highest priority is making the life of legal professionals more efficient, cost-effective, and compliant, which is why we have top-notch security features that keep confidential client information safe. We know attorneys are ethically bound to use secure software tools that ensure client confidentiality, which is why we take our commitment to cybersecurity practices so seriously.

To start, all data managed by CosmoLex’s legal practice management system, including case research, client demographic information, and messages sent on our secure client portal, are encrypted when entered into our system. We even store critical documents in an encrypted state, so no unauthorized viewers can ever obtain confidential information.

We use bank-grade 256-bit SSL encryption standards to protect all data. We require two-factor authentication to be used by each CosmoLex user, to prevent unauthorized accounting system access. Finally, on each account, security permissions can be customized, so only the appropriate law firm employees can access the necessary information.

CosmoLex has received cybersecurity certification with our SOC 2 Type 2 attestation, which requires an independent audit of our security practices by a cybersecurity professional. This was a voluntary certification we pursued to further our cybersecurity practices and continue to serve our clients to the best of our ability.

We also passed a threat assessment analysis test which was performed by leading cybersecurity expert Phalanx Secure Solutions, Inc.

When you purchase a CosmoLex subscription, you access our free, in-house support. We’re available every step of the way to help law firms make the most of our supportive features. When many firms first partner with CosmoLex, they’re transitioning over from a different legal practice management software solution. We help firms safely and securely migrate their existing data with a turn-key service, when requested, to ensure all data is transferred to CosmoLex successfully and without data loss.

Once law firms start using our system, our in-house support team is always available to provide training or onboarding or simply answer specific questions about our products and services. Whether your firm needs help understanding how to create invoices from time entries, set up custom workflows to enhance your project management, use our legal customer relationship management tools to convert more leads to clients, or generate actionable reports from your law firm’s accounting software, our team members are ready and available to assist you.

CosmoLex is designed for attorneys and law firms, but its use has great client features, too. When you use this legal productivity solution to manage your operating accounts, you improve the customer experience from your first touchpoint to your last. CosmoLex’s automation and client management tools help firms streamline client intake, making the process fast and seamless with features like secure document management and sharing and eSignature.

During representation, clients access a secure client portal where they can message their attorney, send and view important documents, and access their billing reports. CosmoLex use also enables clients with the option to pay invoices via credit card or online, improving law firm accessibility and boosting client convenience.

Small and mid-sized law firms especially love the fact that they can create professional-looking invoices and custom reports, and email them to clients with a click, which helps clients get their bills paid by their due date. The legal accounting software can even send automatic billing and late payment reminders to past-due clients to help clients stay on track with payments throughout their matter. Each of these features frees up time for your firm and legal teams in ways that another accounting system like QuickBooks can’t.

Simplify your practice with one tool.